Trust and safety in Asia-Pacific: Closing the gap between growth and risk

This is a defining moment for executives responsible for safeguarding trust. Confidence is under constant threat from escalating and widespread risks: increasingly sophisticated fraud, pervasive misinformation campaigns, debilitating cyber events and the torrent of unsafe user generated content.

We surveyed enterprise decision-makers worldwide to understand how organizations are evolving their trust and safety operations to better combat these threats. Our global findings are outlined in full in our Safety in Numbers: Trust and Safety Trends report.

Here, we deep dive specifically into the results for Asia-Pacific (APAC), which has its own unique set of challenges.

According to Penny Chai, vice president of APAC at Sumsub, the region’s rapid digital expansion is outpacing the rollout of effective fraud-prevention measures. This gap is contributing to heightened risk and declining trust across APAC. Deepfake fraud jumped 194% year over year, and the region fell from third to fourth place globally in fraud-protection rankings, according to Sumsub’s 2025 Global Fraud Index.

The index also shows steep declines across several of the region’s leading digital economies:

- Singapore fell from the global top spot in 2024 to 10th place

- Malaysia plummeted 52 places to 86th

- Indonesia dropped 11 places to 111th

The following APAC-specific snapshot highlights how leaders across the region are responding to rising risk, the challenges they’re facing, how priorities are shifting and whether investment is keeping pace.

Here’s what the data reveals.

What trust and safety challenges are leaders facing?

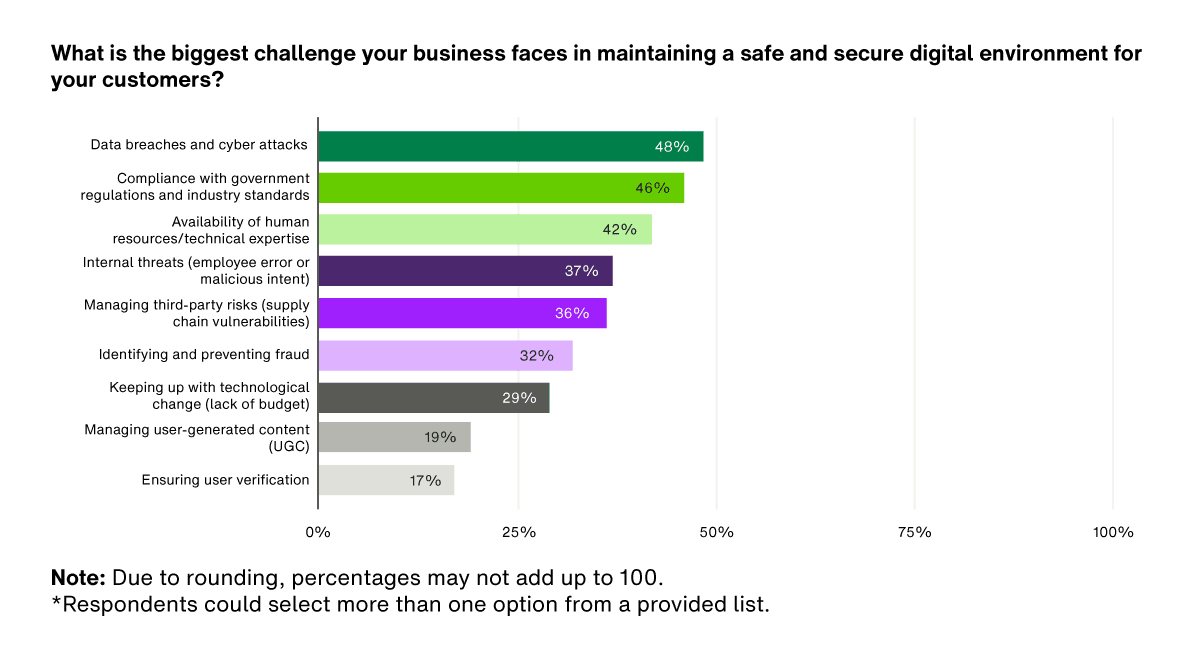

Nearly half (48%) of APAC leaders cite data breaches and cyber attacks as their biggest challenge. Compliance with government regulations and industry standards is close behind with 46%, reflecting how quickly requirements shift — and how differently they can look — across markets within the region.

Notably, 42% of leaders say they’re constrained by limited human or technical capability, suggesting that even when organizations know what “good” looks like, many don’t feel they’re properly resourced to execute against those standards.

Where are APAC trust and safety leaders investing?

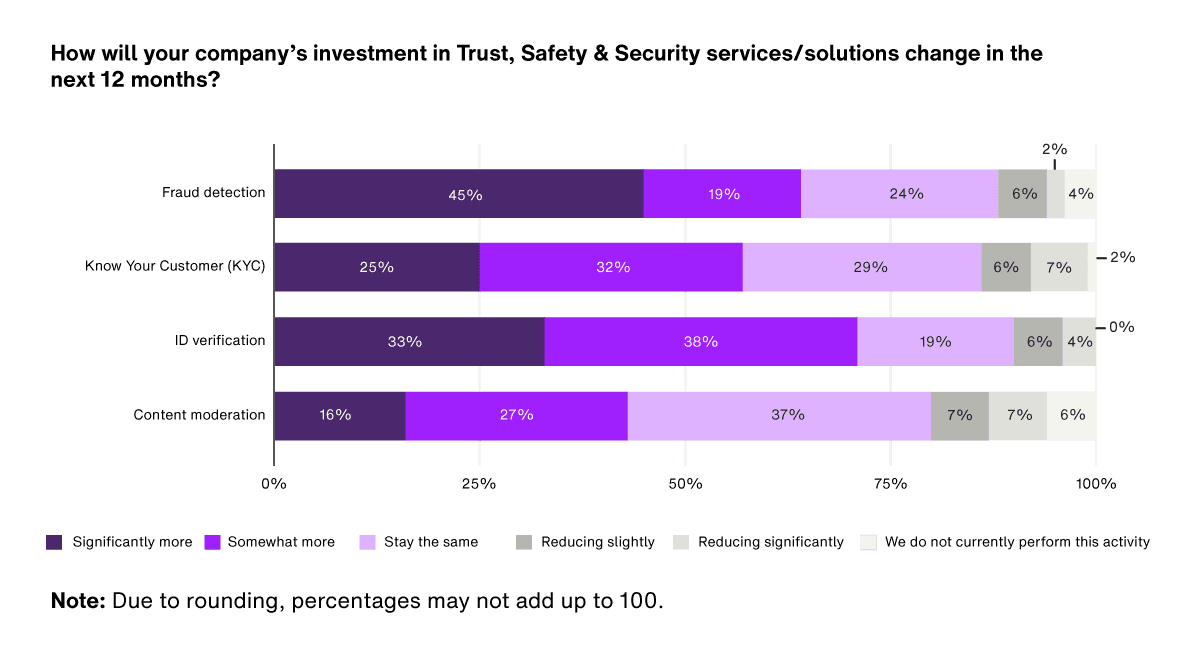

Leaders are increasing investment in three core trust and safety functions — fraud detection, ID verification and Know Your Customer (KYC). Fraud detection is seeing the sharpest rise, with nearly two-thirds planning to spend more in the next 12 months. Identity-related controls are also gaining momentum: the majority (71%) expect to increase investment in ID verification, and 57% in KYC.

Content moderation tells a different story, with half (51%) of leaders anticipating budgets in this area to be reduced or remain flat.

What are the top strategic priorities in trust and safety?

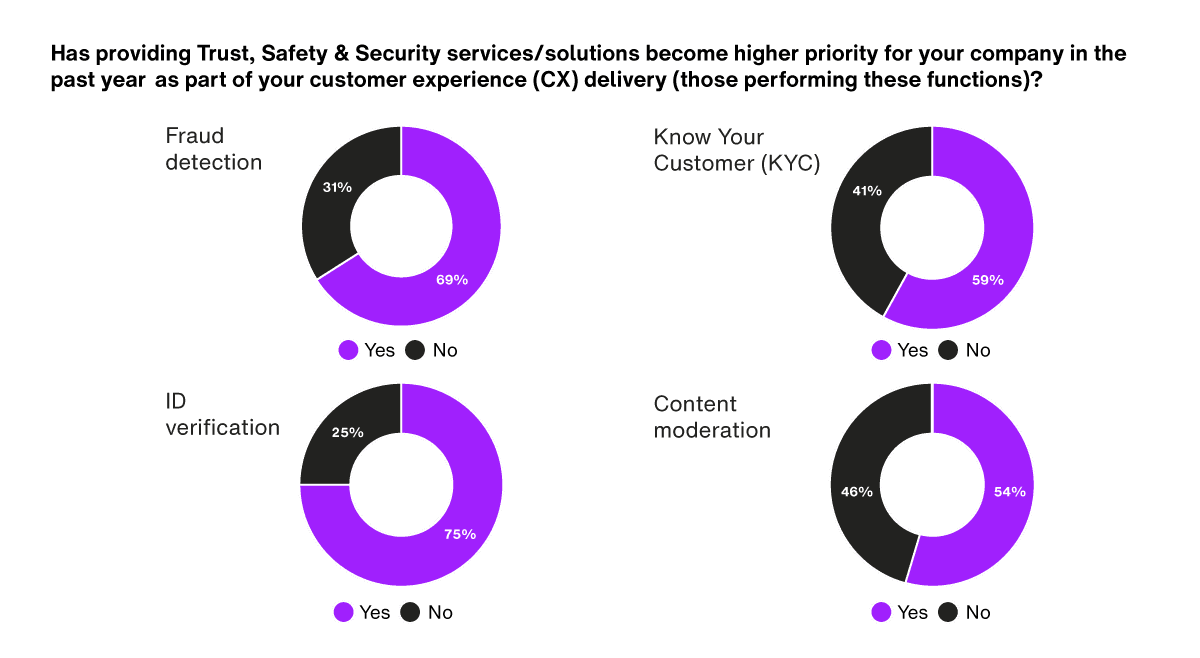

Most respondents say trust and safety has become a higher priority within their customer experience (CX) delivery. The strongest shift is in identity verification, with 75% of leaders saying it’s now a bigger focus for this year, compared to last.

It’s an encouraging trend, especially as organizations think more intentionally about how to design seamless and trustworthy customer experiences. “Too many businesses still treat trust and safety as a backend function, bolted on after a product is designed,” wrote Ljubiša Velikić, VP of trust and safety at TELUS Digital, in a Singapore Business Review article. “But trust is not a feature, it is a foundation that must be designed from the ground up, embedded at every point along the customer journey.”

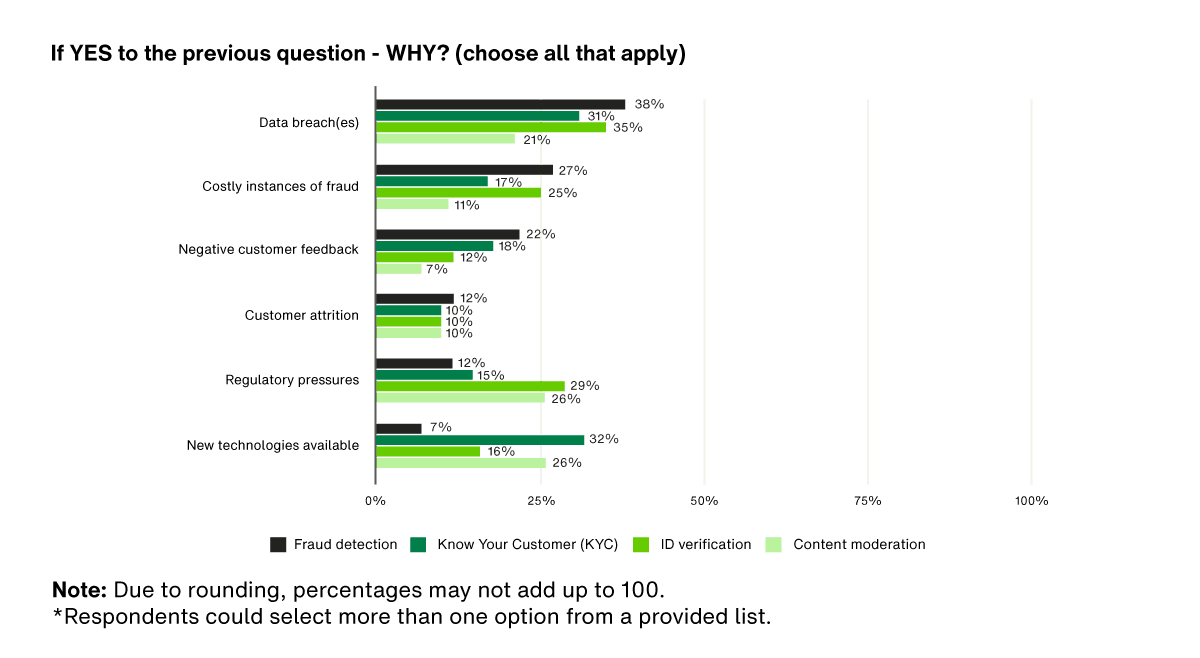

Data breaches are the top catalyst driving increased prioritization — but the secondary drivers look different by function. Costly fraud is a major trigger for fraud detection and identity verification. Meanwhile, KYC and content moderation are being shaped more by new technologies and regulatory pressure.

What challenges are blocking trust and safety delivery?

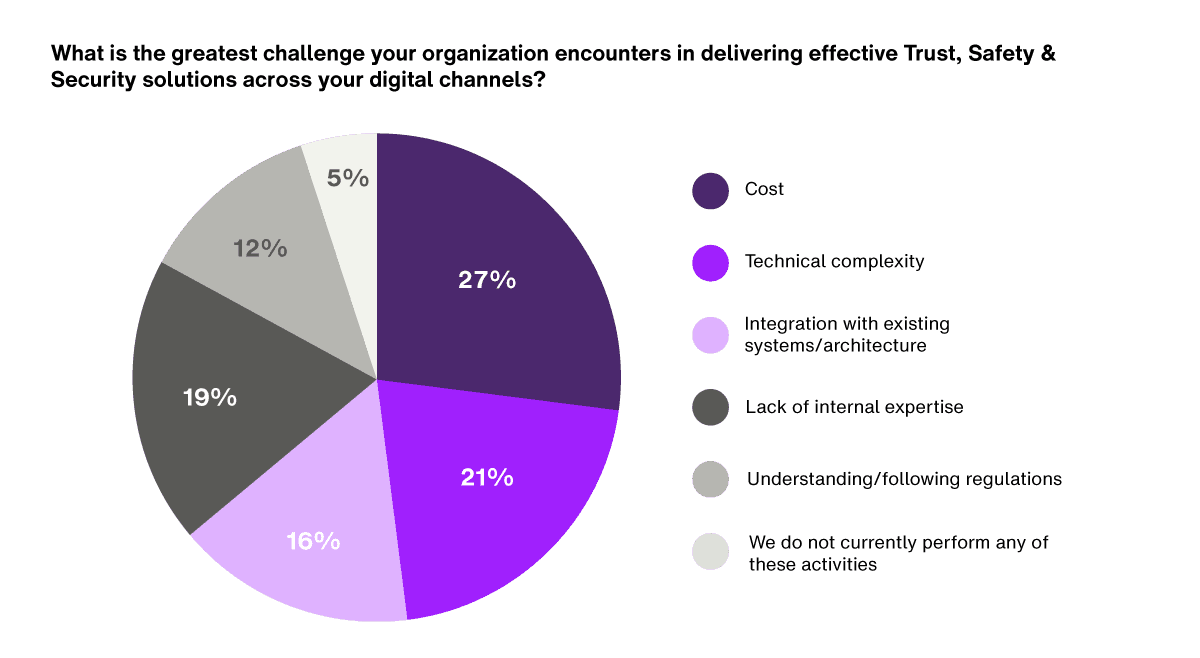

Cost stands out as the single biggest barrier to delivering effective trust and safety solutions across digital channels, cited by 27% of respondents. But financial constraints aren’t the only friction point. Technical complexity (21%) and a lack of internal expertise (19%) are also major blockers — suggesting that even when teams want to advance their approach, many don’t feel equipped to implement or scale it.

What are the most popular trust and safety execution models?

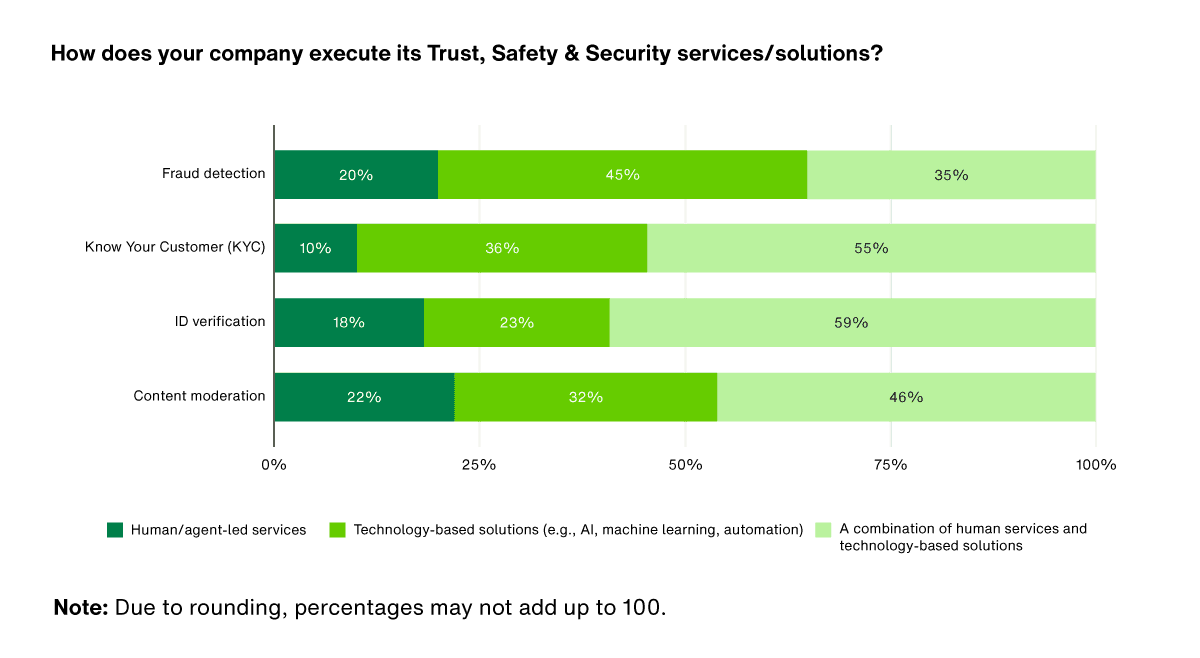

Most teams aren’t relying on just one approach, they’re blending people and technology to deliver effective trust and safety solutions. This is especially true for KYC and identity verification, where a majority of respondents identified using a hybrid model. Fraud detection is the exception, with technology-led solutions identified as the dominant execution model.

Content moderation sits between the two — with nearly half (46%) using hybrid models, but a notable share still leaning more heavily on technology alone. This mix reflects a growing recognition that some risks can be efficiently automated, while others still require human judgment and local context.

The need for hybrid approaches becomes clear when looking at how real-world risks evolve. In the aforementioned Tech in Asia article, Velikić points to Singapore’s fraud landscape as an example. “Scams here are increasingly tailored to local behaviors and cultural nuances,” he explains. “This means that AI algorithms that have been trained on non-geo-specific datasets can actually miss out on critical details necessary for an automated system to detect wrongdoing. In such cases, human-in-the-loop systems become essential. They combine the efficiency of AI with human judgement.”

Secure your platform and protect your users with TELUS Digital

The regional findings show how trust and safety expectations are shifting and how important it has become to scale capabilities with the right mix of people, processes and technology. Organizations across APAC and beyond are looking for support to design safer experiences, strengthen operational resilience and respond confidently as risks evolve.

At TELUS Digital, we’ve been helping global brands safeguard their platforms for more than two decades with a proactive, balanced approach to trust and safety. From fraud detection and prevention, to content moderation and account security, our end-to-end solutions help build trust in digital spaces. Our teams combine global experience with regional expertise to address the specific threats and regulatory requirements facing APAC organizations.

One example is our work with a leading ecommerce marketplace, where we developed a hybrid fraud detection model that combined AI-driven signals with trained specialists. These experts identified counterfeit goods, enforced copyright rules and supported high-risk transactions, while a robust KYC program helped to reduce the risk of fraudulent activity — including risk scoring, identity theft, Account Take Over (ATO) and payment disputes. The program delivered 90% accuracy on manual clean-ups and resolved 99% of cases within 24 hours, helping reduce fraud across the platform. It also gave the client clearer visibility into emerging fraud patterns, enabling faster policy and workflow adjustments.

If you’re exploring how to evolve your strategy or scale your trust and safety capabilities, our team can help assess your needs and guide the way forward.

* TELUS Digital commissioned Ryan Strategic Advisory to conduct a custom global survey in the first quarter of 2025, which forms the basis of this report. The survey reflects the views of 213 enterprise customer experience decision-makers in the AsiaPacific region. Interviews were conducted via telephone in the following languages: English, French, Italian, Japanese, Korean, Dutch or German (depending on the respondent’s country of residence). The revenue mix for enterprise respondents ranged from $10 million to over $5 billion.