The challenge: Make farm credit assessment more efficient so lenders can expand loan access

A leading global credit reporting agency needed to improve its agricultural credit assessment process in Brazil, where farms — especially small and medium-sized farms — often struggle to secure loans.

The world’s fourth-largest producer of food, Brazil has faced significant limitations and inequalities when it comes to farm credit. A study by the Climate Policy Initiative (CPI) based in Rio de Janeiro found:

- Of Brazil’s approximately 5 million farms, about 4 million are family farms of 100 hectares or less.

- Only 15% of family farmers receive credit, dropping to 10% for farms with four hectares or less.

- Large grain-producing farms in the South secure more credit than farms in the North (29% vs 9%), showing how Brazil’s varied geography and crop behavior drive credit inequality.

Traditional farm credit assessment was costly and slow, requiring on-site visits to perform comprehensive technical evaluations. The manual verification process that followed was also costly and slow, stacking up costs while farmers waited.

For a nation that has faced surging agribusiness bankruptcies in recent years, automating the slow and expensive process of securing farm credit would mean much-needed relief for producers and more reliable business for creditors.

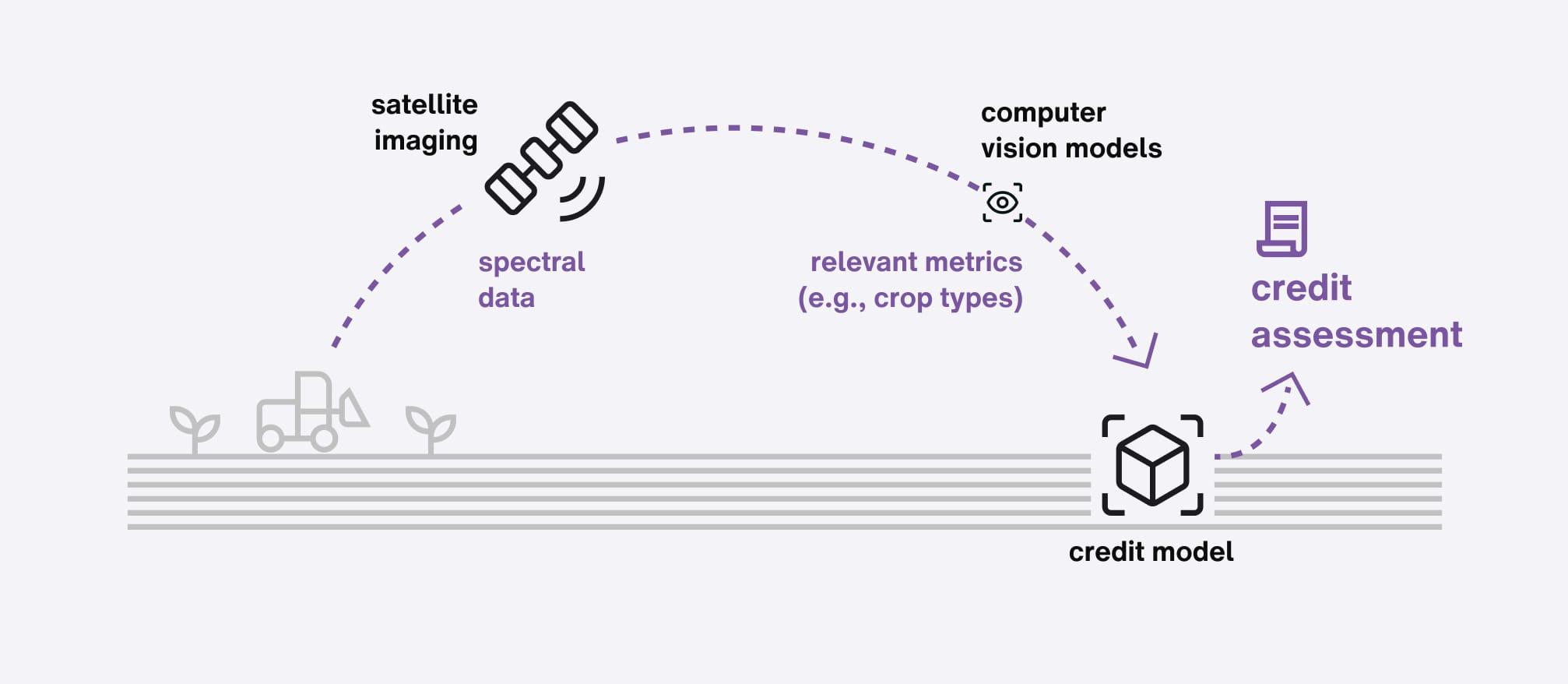

Our approach: Automate credit assessment with satellite-based crop monitoring powered by AI

We helped our client automate the process of assessing farm credit by developing a satellite-based crop-monitoring system. By applying advanced AI and machine learning (ML) to images from Sentinel satellites, our solution could:

- Detect and classify crop types.

- Monitor crop growth cycles.

- Identify key agricultural events (e.g., planting, maturation, harvest).

- Estimate crop yields over time.

When Sentinel-2 generated new images of the earth every five days, specialized computer vision models analyzed the spectral data, including RGB, infrared, UV and SWIR radiance. Tools like s2cloudless enhanced accuracy by removing cloud coverage. We then combined the Sentinel-2 images with the credit reporting agency’s annotations to train our models.

From there, we implemented a scalable API solution for production deployment and supported it with cloud-based processing to handle large-scale machine learning analysis of satellite imagery.

The results: Up to 25,000 farms processed daily in Brazil, with potential to expand markets

With satellite-based crop monitoring powered by AI, our client can process up to 25,000 farms per day across Brazil. In addition to reducing the time and cost of agricultural credit assessments, the agency now provides more accurate credit scoring to agricultural lenders, making farm loans faster to process and at less risk.

For small and medium-sized farms, this means greater accessibility to agricultural loans when they need them. This will help many farmers avoid bankruptcy and build financial sustainability.

And the biggest impact may be yet to come. The global credit reporting agency now has a foundational solution it can expand to other markets, creating a potentially immense growth opportunity.

Innovations like this show how AI makes traditional financial services processes faster, more accurate, and more inclusive. By applying AI to an existing resource like satellite imaging, we streamlined farm credit assessments and opened new possibilities to underserved farmers. This kind of innovation sets companies apart in our industry. It’s not just about adopting new technology; it’s about reimagining entire systems to create value for both businesses and customers.