Powering secure, trusted digital experiences for financial services

Today’s financial customers expect seamless, secure experiences across every digital touchpoint. By combining deep industry expertise, human insight and modern digital platforms, we help create consistent, dependable journeys people feel confident choosing again and again.

Privacy and information security

End-to-end support for the full financial services ecosystem

Financial organizations operate with diverse needs, from secure service delivery to modern digital engagement. Our expertise spans traditional institutions and emerging players alike, helping each navigate industry pressures and deliver meaningful value.

We cover every stage of the banking lifecycle, helping institutions enhance efficiency, reinforce security and deliver clear, reliable experiences for customers.

Strength built on experience, insight and innovation

For over two decades, we’ve partnered with leading financial brands to help them navigate change with clarity and purpose.

Award-winning expertise you can rely on

Our leadership in AI, CX and digital transformation is recognized by respected global award programs, reflecting the strength and reliability we bring to every engagement.

Case studies

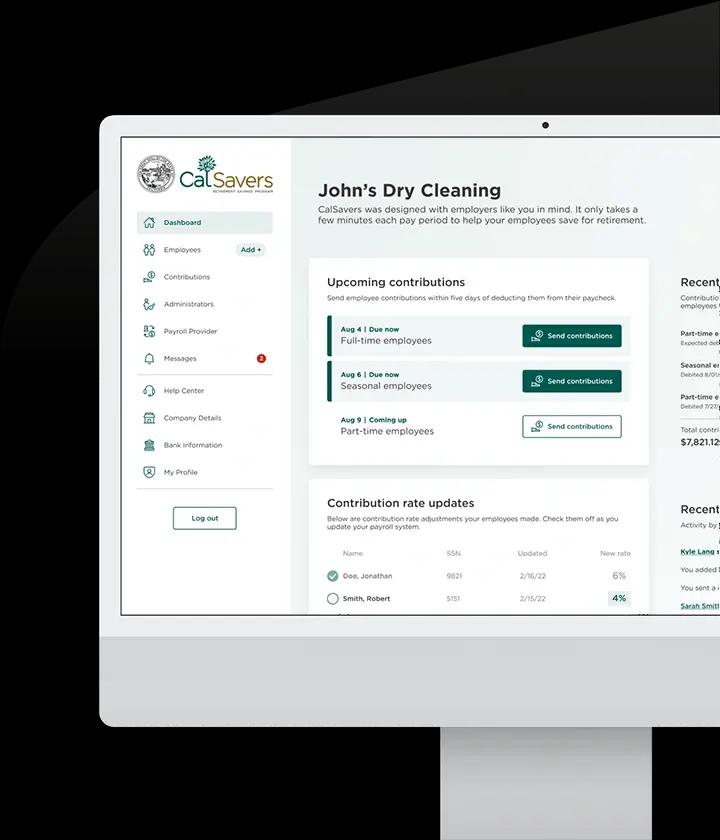

Creating seamless onboarding to expand retirement plan access

Discover how Ascensus doubled asset growth and saved $1M/yr with redesigned enrollment.

- $1MAnnual reduction in operating costs attributed to decreased call center volume

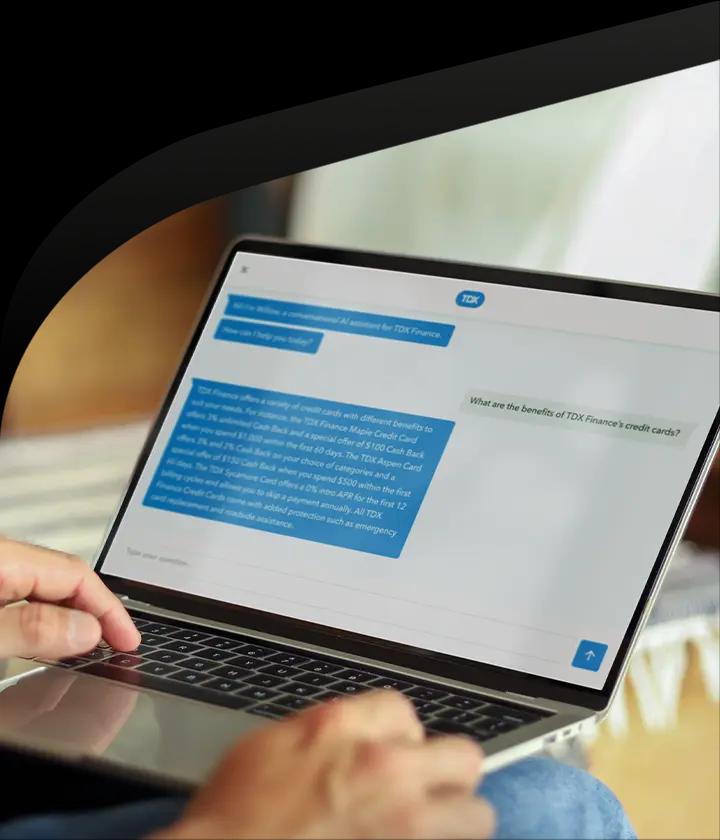

How we deployed a secure conversational AI assistant in eight weeks

See how a major North American financial services firm developed a safe, secure, and expansive conversational AI assistant with help from TELUS Digital.

Read the case study

Transforming customer satisfaction and brand perception for a global payment provider

Discover how our team of experts helped a multinational payments company significantly enhance its customer experience (CX), positioning them as a leader in their industry.

- +86ppIncrease in brand NPS

We are beyond impressed with how TELUS Digital treats their employees and love the fact that it translates into how agents treat our customers. This has by far been the best strategic outsourcing move in my 20 plus years of experience.

I tested 24 AI banking chatbots; they were all exploitable

Milton Leal, lead applied AI researcher at TELUS Digital explores how adversarial tests exposed chatbot vulnerabilities and how leaders can prepare.

Banking, Financial Services & Insurance Insights

See all

Fuel your growth with the right expertise

See how we can help you build safer, smarter and more seamless financial journeys.

Speak with an expert